FOR IMMEDIATE RELEASE

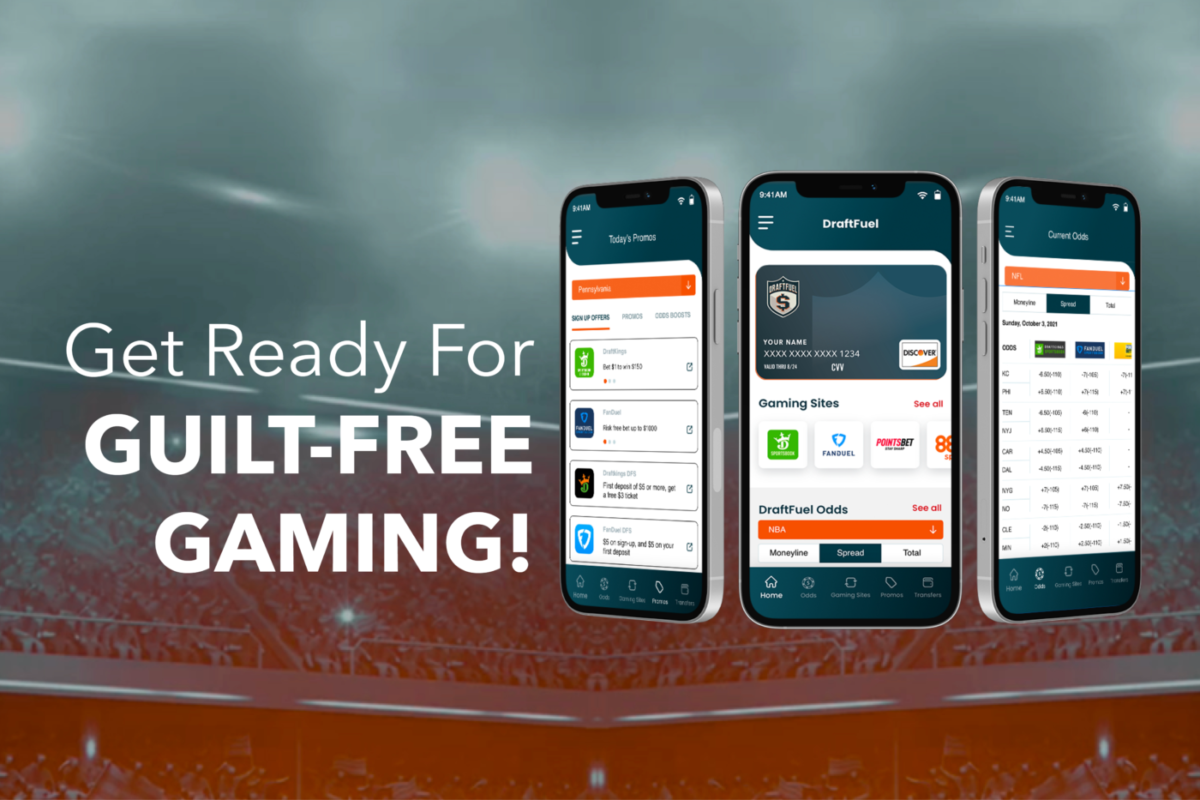

PHILADELPHIA, PA (November 15th, 2021) – DraftFuel, a FinTech startup in the online

sportsbook, casino, and daily fantasy sports space, is launching an app and Discover prepaid

card product. As more states legalize sports betting, DraftFuel seeks to help consumers take a

proactive approach to responsible gaming by providing financial guardrails for the influx of new

players flooding the market.

Co-founder Alex Cullingford added, “We wanted to create DraftFuel to help individuals of any

experience level enjoy guilt-free gaming. That’s why, beyond the app itself, we will be producing

content that our user-base can take advantage of to make smart, responsible decisions.”

Acting as a dedicated gaming fund, the app + debit card enables users to accumulate money in

their DraftFuel account via two primary methods. Users can connect their pre-existing debit or

credit cards to the app to be monitored for the accumulation of “spare change” from everyday

purchases such as gas and coffee. In addition, users can set up a fixed percentage of their bank

deposits (Ex: up to 5% of direct deposits) to be automatically transferred to their DraftFuel

account. Both methods mitigate risk by empowering users to only play with “true discretionary

funds.”

This announcement is enabled by DraftFuel’s partnership with Central Payments and their

Open*CP Fintech API Marketplace, one of the only true bank-as-a-service payments platforms

powered by a full-scale digital payments bank. Open*CP provides access to the entire

payments ecosystem through its embedded suite of services. As a participant in the third cohort

of Falls Fintech, a Central Payments accelerator program, DraftFuel found an elite, long-term

partner with Central Payments. Falls Fintech and Central Payments provided a large network of

industry leaders, progressive curriculum, bank partner, and access to Open*CP’s entire

payments ecosystem to expedite DraftFuel’s market readiness.

The app will be able to be used at all major online sportsbooks, casinos, and sports fantasy

sites. In addition, the accompanying prepaid card can be used for everyday purchases as well.

DraftFuel has partnered with Discover Global Network, allowing their customers to make

purchases anywhere Discover is accepted.

“Partnering with a company like DraftFuel is an example of how we’re introducing exciting new

payment methods into a growing industry.” said Dane James, Global Business Development at

Discover Global Network.

In 2020, $21 Billion was wagered in just 20 states that offered legalized sports betting. As more

states pass legislation to legalize the activity, that number could skyrocket. The need for a

financial platform like DraftFuel will mirror that rise as new, inexperienced players enter the

space. In addition to the product itself, DraftFuel is committed to adding value to the

marketplace by providing educational resources that will reaffirm their higher purpose – that of

responsible gaming.

The app and Discover prepaid card are currently scheduled for release in the Fall of 2021, and

those interested can join the waitlist at DraftFuel.com.

About DraftFuel

DraftFuel was co-founded by Tom Mangan and Alex Cullingford in 2019 when a discussion

during a family vacation led to identifying an opportunity to create value in the online gaming

sector. DraftFuel is a secure bankroll management platform that helps individuals self-regulate

their online gaming budget. Accumulated funds can be seamlessly deposited to a user’s gaming

account or used for purchases wherever Discover is accepted. Additional features include odds

comparison tables and promotional offers. For more information, visit DraftFuel.com.

About Central Payments

Central Payments is the payments subsidiary of Central Bank of Kansas City and is

headquartered in South Dakota. Central Payments administers payment solutions for partners

through its own Open*CP Fintech API Marketplace, one of the only true bank-as-a-service

payments platforms and the technology responsible for Central Payments’ rise to the fastest

growing prepaid card issuer since 2015.* Along with its fintech accelerator program, Falls

Fintech, Central Payments produces a podcast called Fintech Brews & News where you can

find unique perspectives on how to bridge the gap between banking, startups, and the entire

fintech industry. Member FDIC.

* Source: The Nilson Report, 2015 to 2019.